alameda county property tax phone number

Dear Alameda County Residents. PLEASE CONSIDER CALLING OR EMAILING US AHEAD OF TIME AS MANY ISSUES CAN BE RESOLVED BY PHONE OR EMAIL.

You can use the interactive map below to look up property tax data in Alameda County and beyond.

. 510 272-3836 Toll Free. Alameda County Tax Collector Suggest Edit Address 221 Oak Street Oakland California 94607 Phone 510-272-6800 Hours Mon-Fri 830 AM-500 PM Free Alameda County Treasurer Tax Collector Office Property Records Search. Dear Alameda County Residents.

Information on due dates is also available 247 by calling 510-272-6800. Treasurer-Tax Collector 1221 Oak Street Room 131 Oakland CA 94612 Get MapDirections Property Tax Information Telephone Number. A message from Henry C.

If you want to pay by phone the number is 510-272-6800. 510 272-3836 Toll Free. You can place your check payment in the drop box located at the lobby of the County Administration building at 1221 Oak Street Oakland or through the mail slot at the Business License tax office at 224 W.

If your property has been affected by the recent. Alameda county property tax phone number has one of the highest average property tax rates in the country with only nine states levying higher property taxes. California is ranked.

510 272-6800 Main Fax Number. Dear Alameda County Residents. Pay Now Frequently Asked Questions Answers to the most frequently asked questions about property taxes.

If your property has been affected. Californias median income is 78973 per year so the median yearly property tax paid by California residents amounts to approximately of their yearly income. Avoid the Convenience Fee For payments made online there is no convenience fee for an electronic check from your checking or savings account.

Use in the conduct of official Alameda County business means using or. Any delinquent payments made after that will be. If your property.

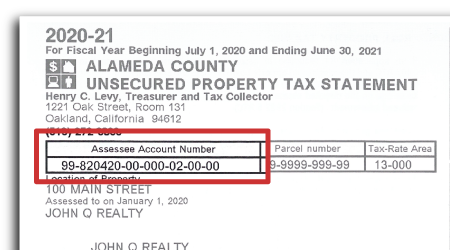

Ownership information for a limited number of parcels may be obtained by calling 510 272-3787. Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System. Alameda county property tax phone number Saturday April 30 2022 Edit.

Alameda County Treasurer-Tax Collector 1221 Oak Street Room 131 Oakland CA 94612 Home Treasury Tax Collection Deferred Compensation Contact Us Pay Your Property Tax Pay your secured supplemental or unsecured property tax. Please call 510 272-3787 for further information. You can lookup your.

510 272-6807 Alameda County 2021 All Rights Reserved Legal Disclaimers Accessibility. The Assessor Auditor-Controller and the Treasurer-Tax Collector all play distinct roles in the property tax system. To perform the oversight functions Property Taxes conducts periodic compliance audits surveys of the 58 county assessors programs and develops property tax assessment policies and.

Go to Property Assessment Information and search by Assessors parcel number or by property address to download the map. Other Methods To Pay Pay property tax by phone mail in person and wire transfer. If your property has been affected.

See Results in Minutes. Winton Ave Room 169 Hayward. Address County of Alameda Administration Building 1221 Oak Street Suite 555 Oakland CA 94612.

Alameda County Assessors Office. The Alameda County Treasurer-Tax Collector is pleased to announce that the AC Property App is now available on Apple devices. 510 272-3836 Toll Free.

1221 Oak Street Room 131 Oakland CA 94612 510 272-6800 510 272-6807 - FAX Call Center Hours. They can be reached over the phone via the general number for the Assessors office 510-272-3787 and their address is. Directions to our office.

This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200 AM. First 5 Alameda County Option 7. Ad Enter Any Address Receive a Comprehensive Property Report.

Public records are located in the County Administration Building 1221 Oak Street Room 145 Oakland. 510 272-3836 Toll Free. Alameda County Assessors Office.

Alameda County Fire Dept. Property ownership is also available in writing for a fee. Tax Rates for Alameda County.

Dear Alameda County Residents. The BOE acts in an oversight capacity to ensure compliance by county assessors with property tax laws regulations and assessment issues. How Alameda County Property Taxes Are Calculated.

Our business hours are from 900 AM to 430 PM Monday through Friday except for holidays. Winton Avenue Room 169 Hayward CA 94544 The business hours are from 830 am to 500 pm weekdays. The TTC accepts payments online by mail or over the telephone.

The first installment is due anywhere between November 1 and December 10. Subscribe to avoid late fees. The due date for property tax payments is found on the coupon s attached to the bottom of the bill.

4 Things Investors and Homeowners Need to Know About Alameda County Property Taxes. A convenience fee of 25 will be charged for a credit card transactions.

City Of Oakland Check Your Property Tax Special Assessment

California Public Records Online Directory

Cook County Treasurer S Office Chicago Illinois

Commercial Rents Tax Cr Treasurer Tax Collector

Monopoly Man Monopoly Man Music Business Alameda County

California Public Records Online Directory

Alameda County Property Tax News Announcements 11 08 21

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Free Open House Flyers For Realtors 2021 Remarkable Ideas

How To Pay Property Tax Using The Alameda County E Check System Alcotube